Search for library items search for lists search for. A comparative approach with materials and cases a schema.

Chapter 5 Cost Comparison Analysis Costs Of Alternative

Chapter 5 Cost Comparison Analysis Costs Of Alternative

The comparative presentation of this volume offers an analysis of policy issues relating to tax structure and tax base as well as insights into how cases arising out of vat disputes have been resolved.

Value Added Tax A Comparative Approach With Materials Cases Mobi Download. Value added tax a comparative approach with materials cases are not only beginning to rival conventional literature. Value added tax. This book integrates legal economic and administrative materials about the value added tax vat to present the only comparative approach to the study of vat law.

The comparative presentation of this volume offers an analysis of policy issues relating to tax structure and tax base as well as insights into how cases arising out of vat disputes have been resolved. It also serves as a resource for tax practitioners and government officials that must grapple with issues under their vat or their prospective vat. Comparative analysis of value added tax revenue among different sector in nigeria case study of federal inland revenue lagos state largest undergraduate projects repository research works and materials.

Survey of taxes on consumption and income and introduction to value added tax forms of consumption based taxes and altering the tax base varieties of vat in use registration taxpayer and taxable business activity taxable supplies of goods and services and tax invoices the tax credit mechanism introduction to cross border aspects of vat timing and valuation rules zero rating and exemptions and government entities and non profit organizations gambling and financial. The second edition includes new vat related developments in europe asia africa and australia and adds new chapters on vat avoidance and evasion and on chinas vat. It also serves as a resource for tax practitioners and government officials that must grapple with issues under their vat or their prospective vat.

Download undergraduate projects topics and materials accounting economics education. This book integrates legal economic and administrative materials about the value added tax vat to present the only comparative approach to the study of vat law. Value added tax this book integrates legal economic and administrative materials about the value added tax vat to present a comparative approach to the study of vat law.

As a result of these recent advances value added tax a comparative approach with materials cases are becoming integrated into the daily lives of many people in professional recreational and education environments. Request pdf on researchgate value added tax. Worldcat home about worldcat help.

A comparative approach with materials and cases. Its principal purpose is to provide comprehensive teaching tools laws cases analytical exercises and questions drawn from the experience of countries and organizations from all areas of the world. The comparative presentation of this volume offers an analysis of policy issues relating to tax structure and tax base as well as insights into how cases arising out of vat.

A comparative approach second edition this book integrates legal economic and administrative materials about the value added tax vat to.

Health Motivated Taxes On Red And Processed Meat A

An Empirical Study Of Customers Awareness Towards Value

An Empirical Study Of Customers Awareness Towards Value

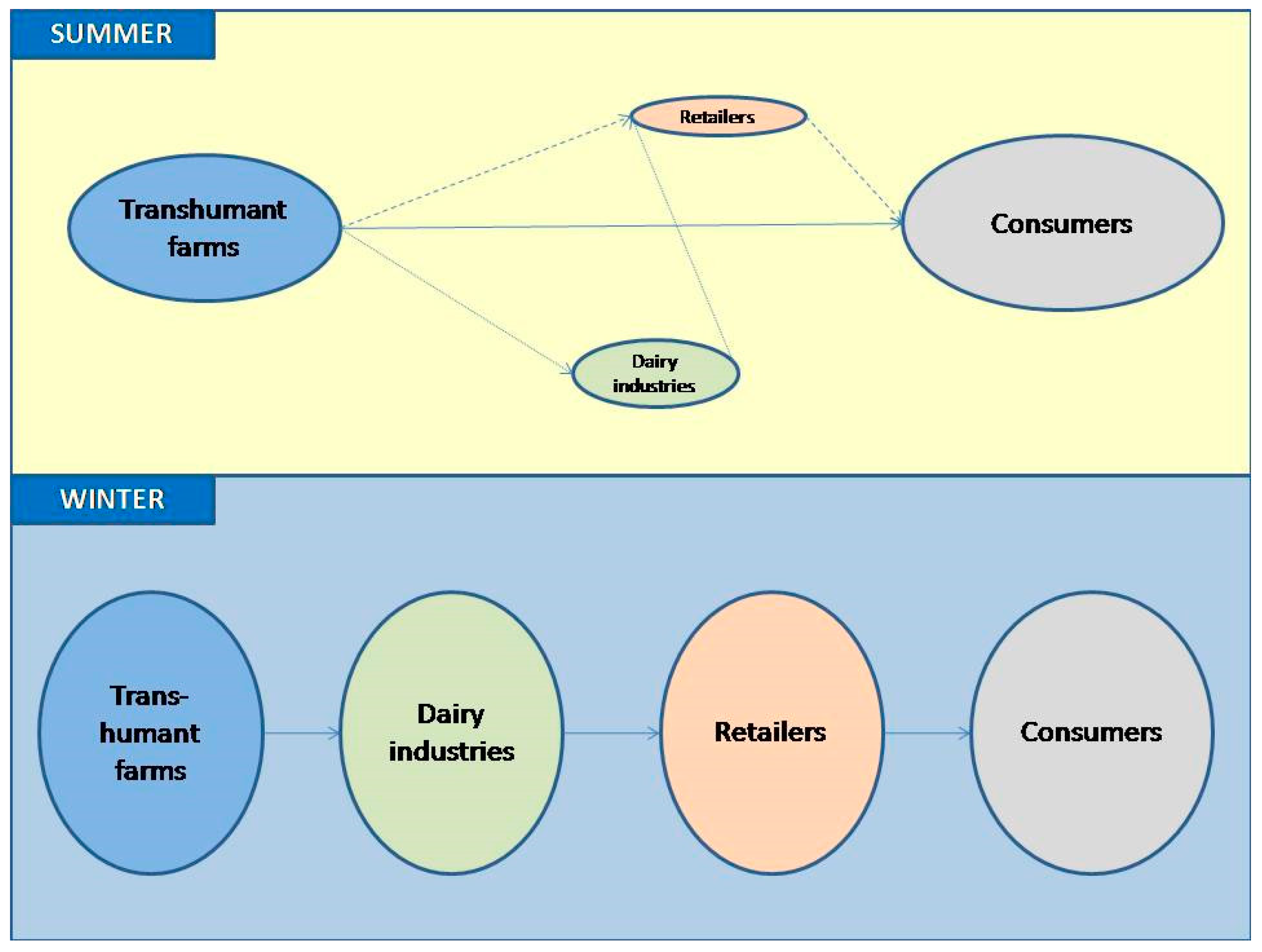

Sustainability Free Full Text Alternative Approaches Of

Sustainability Free Full Text Alternative Approaches Of

Fiscal Decentralisation And Decentralising Tax

Fiscal Decentralisation And Decentralising Tax

Economic Value Added Eva Formula Calculation Top

Economic Value Added Eva Formula Calculation Top

163 Prepare The Statement Of Cash Flows Using The Indirect

Project Report On Gst 2018

Project Report On Gst 2018

International Brand Strategy Case Analysis According To The

International Brand Strategy Case Analysis According To The

Cambridge Tax Law Series

Cambridge Tax Law Series

Amazoncom Value Added Tax A Comparative Approach With

Amazoncom Value Added Tax A Comparative Approach With

Mental Accounting Of Income Tax And Value Added Tax Among

Mental Accounting Of Income Tax And Value Added Tax Among

Difference Between Vat And Gst With Comparison Chart Key

Difference Between Vat And Gst With Comparison Chart Key

Letter Of Comment No 109 File Reference 1204 001

Pdf Effective Value Added Tax An Imperative For Wealth

Pdf Effective Value Added Tax An Imperative For Wealth

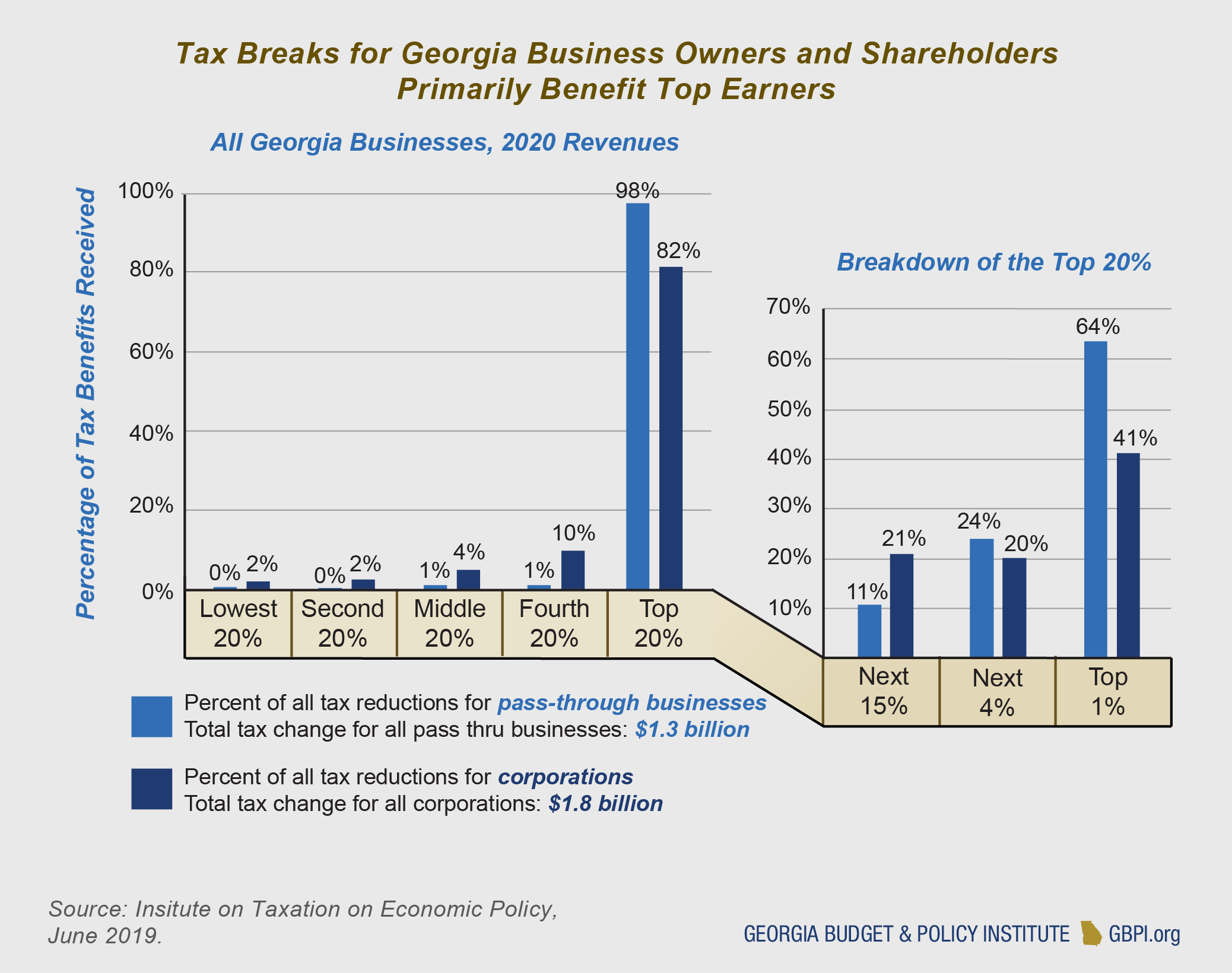

The Tax Cuts And Jobs Act In Georgia High Income Households

The Tax Cuts And Jobs Act In Georgia High Income Households

0 Response to "Value Added Tax A Comparative Approach With Materials Cases Free Epub"

Post a Comment