This is a crime that consists of the concealment of certain assets unlawfully origin so that they appear to be from a legitimate source. Introduction to the model provisions.

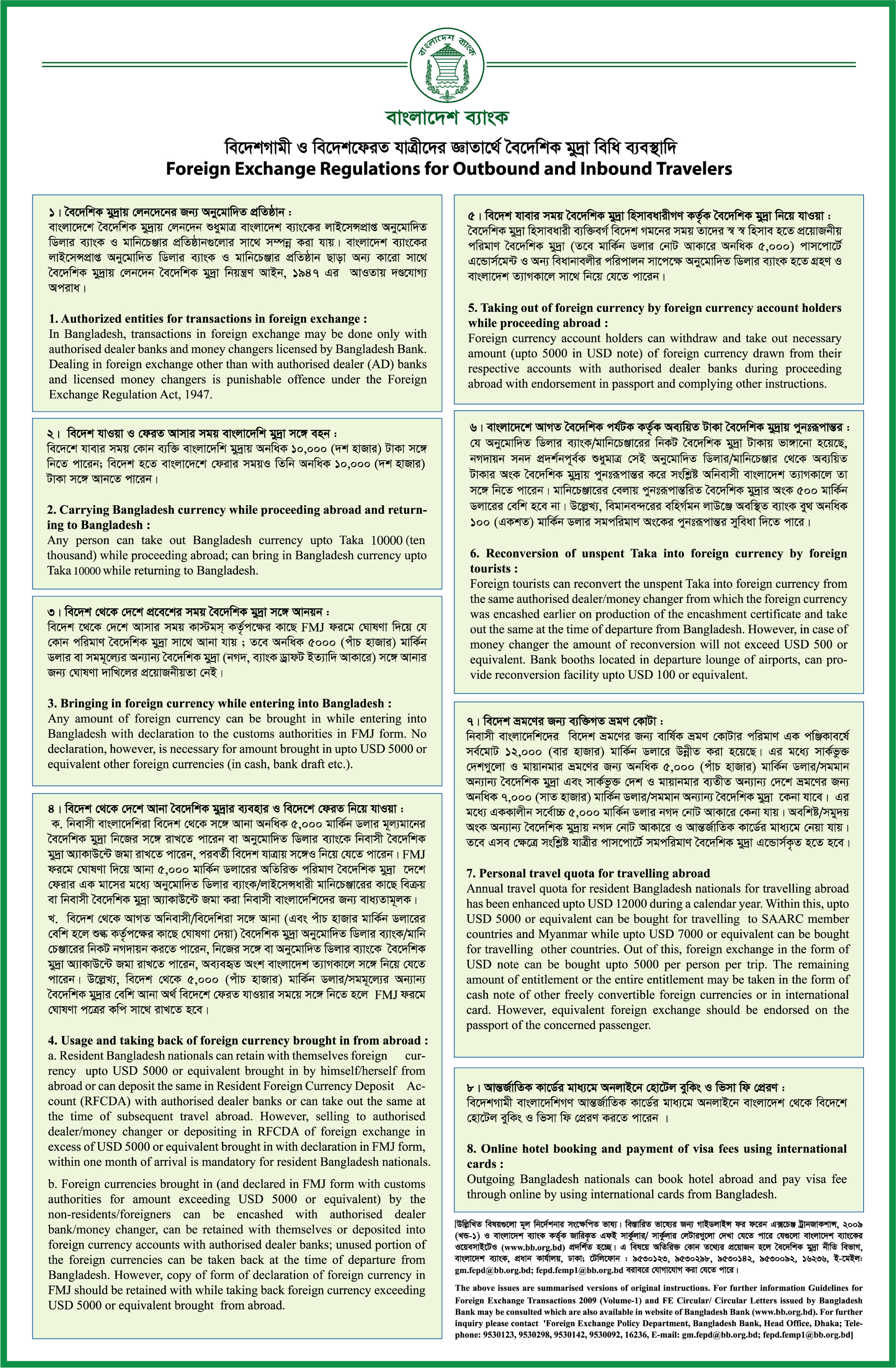

Regulations And Guidelines

Regulations And Guidelines

Due to the large amount of information in the banks detecting such behaviors is not feasible without anti money laundering systems.

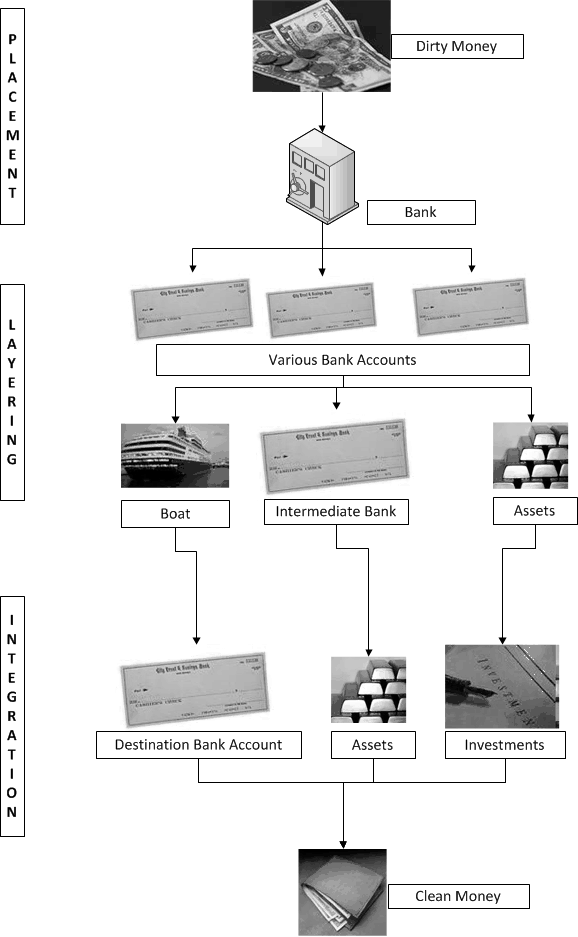

[PDF] Read Online And Download Prevention Of Money Laundering And Suggestion Model For Banking System. The money laundering process is composed by three phases. The system for prevention of money laundering is a complex and composed process of three main pillars with aimed to build a strategy which include measures and activities to identify suspicious financial transactions identification of criminals and providing evidence of the committed crime that resulted in criminal proceeds and security freezing and confiscation through criminal money trail. To hide the source and beneficial ownership of money.

Money laundering is becoming a significant risk to the banking industry. Placement accumulation and integration. And to provide storage for bank notes through a safe deposit facility.

It brings with it negative results such as damage to the banking industry reputation escalation. Prevention of money laundering and suggestion model for banking system money laundering as a problem exceeded the national boundaries and became an international one. Prevention of money laundering and suggestion model for banking system paperback july 1 2015 by safdari akbar author be the first to review this item see all formats and editions hide other formats and editions.

Funds obtained by crime using the banking system. In order to prevent the black money and money laundering countries. Money laundering detection is one of the areas where data mining tools can be useful and effective.

These activities are commonly referred to as money laundering. These model provisions on money laundering financi ng of terrorism proceeds of crime and civil forfeiture are the outcome of a collaboration between the commonwealth secretariat the international monetary fund imf and the unite d nations office on drugs and crime unodc. Of the main problems faced by a banking institution is money laundering.

Whatever the legal position in different countries the committee considers that the first and most important safeguard against money laundering is the integrity of banks own managements and their vigilant determination to prevent their institutions becoming associated with criminals or being used as a channel for money laundering. Associates use the financial system to make payments and transfers of funds from one account to another.

Understanding The Risks Of Money Laundering In Sri Lanka

International Compliance Training Views And Blogs Skills

International Compliance Training Views And Blogs Skills

Money Laundering Moneylaunderinglegal Anti Money

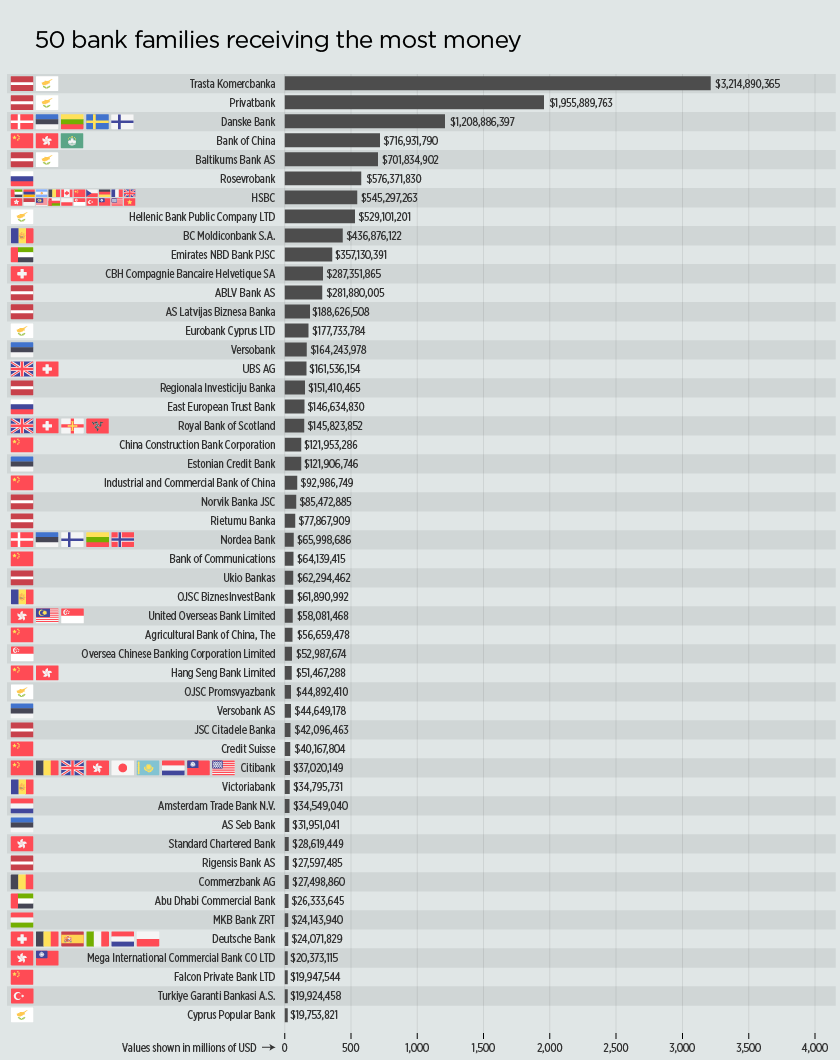

Deutsche Bank Mirror Trades And More Russian Threads The

Deutsche Bank Mirror Trades And More Russian Threads The

Non Standard Policies And The Ecb

Guidance For Effective Amlcft Transaction Monitoring Controls

Anti Money Laundering The Law Society

Anti Money Laundering The Law Society

Estonian Regulators And European Central Bank Move

Estonian Regulators And European Central Bank Move

Documents Financial Action Task Force Fatf

Documents Financial Action Task Force Fatf

What Banks Must Do To Prevent Money Laundering The Asian

Moving To Intelligence Led Anti Money Laundering

Moving To Intelligence Led Anti Money Laundering

Professional Money Laundering

Hong Kongs Money Laundering Terrorist Financing Mltf

Ai As New Tool In Banks Crime Fighting Bag American Banker

Ai As New Tool In Banks Crime Fighting Bag American Banker

0 Response to "[pdf] Read Online And Download Prevention Of Money Laundering And Suggestion Model For Banking System"

Post a Comment